Les signatures électronique sont fortement en place dans l'assurance-vie et Celent s'attend à ce que la tendance s'accélère. Les assureurs retirent le papier des processus quotidiens et les signatures électronique constituent un moyen sûr d'offrir aux clients une expérience numérique conviviale. Cet extrait de 37 pages de Celent's Putting a Lock on STP - Life Insurance E-Signature Vendors 2017 offre un aperçu unique du marché actuel des signatures électroniques. Il examine l'évolution de la technologie, utilise des cas de signatures électronique pour l'assurance-vie et compare les fournisseurs du monde entier.

Dans ce rapport, vous apprendrez :

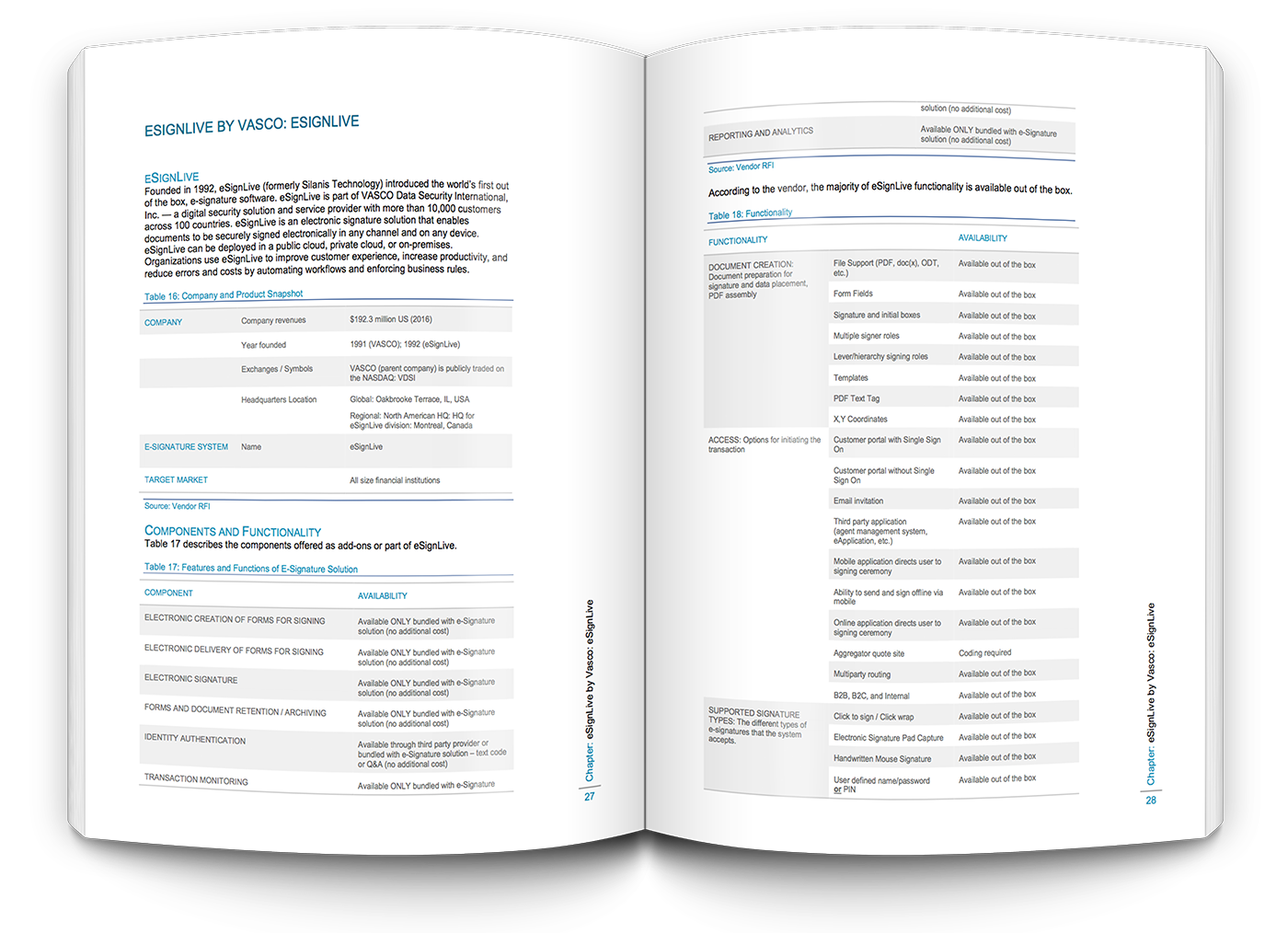

- Une analyse de 11 solutions de fournisseurs e-signature mettant l'accent sur la technologie, la fonctionnalité, les capacités de service et la clientèle

- Comparaisons de plongée profonde de OneSpan Sign, DocuSign, Adobe Sign

- Une e-signature pour la liste de contrôle de l'assurance-vie lors de l'examen des fournisseurs

- Les recommandations de Celent sur le départ

Téléchargez ce rapport dès maintenant >>