Executive Summary

- Cut agreement closings from four days to two or fewer

- Eliminated email complaints; improved customer satisfaction

- Faster signing accelerates time to revenue

- Public cloud option launched initial deployment quickly

- Options available for private cloud and on-premise deployment

- Can scale quickly across the enterprise

- Easy experience for signers and senders encourages adoption

A OneSpan Sign signature embeds all the necessary forensics in the PDF. Our legal team felt that this was stronger than just an ink signature; they liked it better.

Challenge: Establish a Uniformly Excellent Customer Experience Across the Entire Enterprise

This top 20 financial institution, a regional banking power with more than 1,000 branches across the southern United States, is committed to applying a “personal touch” to its consumer, business, corporate, and institutional clients. Recognizing the need to go digital to enhance the client experience and remove paper costs and inefficiencies, the bank launched a Digital Enterprise initiative. This umbrella program included a number of projects such as delivering statements through online banking instead of postal mail, digitizing internal reporting, and standardizing on an e-signature solution.

For e-signatures, the approach was simple. The bank wanted to lay the groundwork at the enterprise level to ensure a uniform, consistent approach to e-signing, no matter how simple or complex the workflow. By adopting e-signatures at the enterprise level, the bank could establish a common foundation for adoption, allowing business lines to incorporate the solution at their own pace without making redundant investments in coding or implementation.

Solution: OneSpan Sign Flexibility Delivers Deployment Speed with Future-proof Adaptability

During the RFP, the bank considered a variety of e-signature options, a rigorous process that also required due diligence by the corporate legal team. OneSpan Sign stood out as having the strongest security and most comprehensive audit trails—the only solution to record and replay the entire document signing process as experienced by signers, with evidence of who read and signed individual pages at precise dates and times. Further, OneSpan Sign locks down the document after each signature, protecting it against tampering or modification as it moves among signatories. The resulting e-signature was not merely “as good” as a traditional signature, but better.

The bank also found that OneSpan Sign stood out in these categories:

Go Live Quickly, Integrate Later

The bank began by using the OneSpan Sign web app, an instant way to implement e-signatures and immediately enhance the client experience. At a later date, it can integrate with their core systems to fully automate higher volume processes and create white labeled experiences.

Flexibility in Deployment

OneSpan Sign can be deployed in the cloud or on-premises, giving the bank the flexibility it needs for enterprise-wide adoption. To facilitate a rapid rollout, Treasury began in the cloud, knowing they can move to a private cloud or on-premises at any point.

Easy for senders and signers

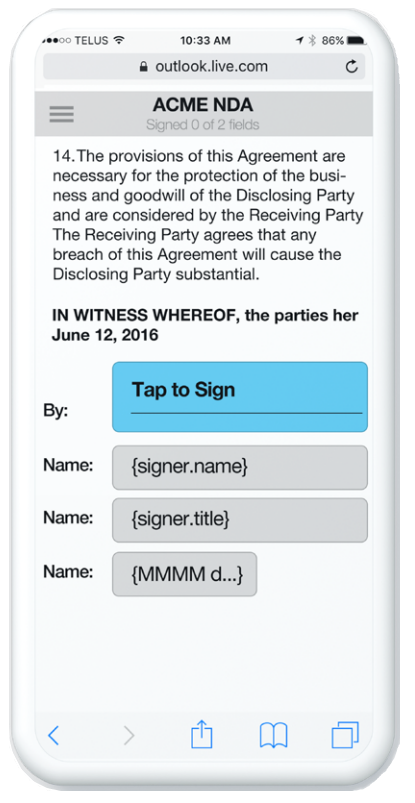

With thousands of potential users, it was important for the bank to make the signing process as simple and straightforward as possible. The OneSpan Sign UI makes it easy for employees to drag and drop signature fields into their documents, create templates, and use the dashboard for tracking document status. For the customer, signing is as easy as a few clicks or taps on any device.

Expanding E-Signatures from Customer Facing to B2B and Internal Use Cases

Customer-facing: Treasury Management

In 2015, Treasury and Payment Solutions, seeking ways to reduce customer onboarding delays, became the first line of business to begin using the new way of signing. Under its previous system, service agreements were distributed to clients by email; to formally approve the contract and initiate service, clients had to return the email with the attachment and the word “Approved” in the email. If either element was missing, the bank representative had to reconnect with the client – sometimes over multiple email exchanges. “A confusing process that prompted a lot of unnecessary back and forth,” says the SVP of Treasury Management. “Not an ideal customer experience.”

Treasury attempted to resolve the problem with temporary workarounds, such as a “negative consent” option on simple products. But riskier products involving wire transfers, ACH authorizations, and security administrator agreements still required signatures, and these constituted 35% - 45% of Treasury’s business, each with an average turnaround time of four days. The SVP of Treasury Management recognized that e-signatures could simplify and accelerate the approval process. “The faster we can onboard clients, the faster they get the services they need, such as payroll processing,” he notes, “and the faster we start to realize revenue from those services.”

“Part of our commitment is ensuring we have all the valid information for the authorized signers: who they are, their email addresses, being sure those addresses match their corporate accounts,” he said. “A OneSpan Sign signature embeds all the necessary forensics in the PDF. Our legal team felt this was stronger than an ink signature; they liked it better.”

ESIGN Committee

To encourage widespread adoption of OneSpan Sign, the bank created an ESIGN Committee, with representatives from IT, legal, and other departments. Committee members assist with the adoption of OneSpan Sign within the bank and meet monthly to review e-signature requests from the various lines of business.

One Committee member is an Operations Analyst with the bank’s Print and Distribution Services department – where the need to reduce postage expenses is especially obvious. “Since we work directly with FedEx, USPS, and Pitney Bowes, we can actually see where we’re spending a good bit of money shipping paper documents,” she says. Finding ways to reduce those costs is helping to drive the gradual expansion of e-signatures across the bank.

B2B: Strategic Sourcing Management Group

In the fourth quarter of 2016, the Strategic Sourcing Management Group became the second adopter. To maximize adoption, the Group decided to mandate e-signatures.

The bank launched a series of training sessions for its attorneys (~40) and procurement contractors. Like Treasury, they are using the OneSpan Sign web app to manually upload and prepare documents for e-signature. Signer identity is verified through email authentication. The signer is sent an email, inviting them to access the e-signing ceremony by clicking a link embedded in the email. The authentication happens when the signer logs in to their email account. Each signer then reviews the document and clicks to sign in a browser. Typically one signature is required from the bank and one from the vendor.

“When contracts need to be signed, some of the attorneys may be traveling as well as some of the service vendors who need to sign the contract. With the convenience of using OneSpan Sign, they don’t have to be in the office, near a fax machine or a scanner; they can actually just open up the email on their device from wherever they are and e-sign,” says the Operations Analyst.

SPEED AND CONVENIENCE FOR A BUSY RESTAURANT OWNER

Does speed and mobile access really make a difference? When you’re managing multiple restaurants across the US, it does.

And when you’re the banking advisor serving that client, you had better make the signing process prompt and convenient. Early into the OneSpan Sign deployment, the SVP of Treasury Management got an urgent call from an advisor who was unfamiliar with new e-signature tool—they had an impatient client waiting on a plane, eager to finalize an onboarding agreement before take-off.

“I had to quickly go online and talk the advisor through it,” he says. “The client clicked and signed it within minutes. I know the client was sitting on the tarmac, but they were able to sign off from their mobile device.”

The busy restaurant owner texted back one word: “Fantastic!” There was no way the client would have been able to do that if the bank was still doing business with pen and paper.

Internal: Risk Management Team

Given the regulatory environment in which the bank must operate, documenting compliance among its internal team is essential. The Risk Management Team must sign off on time-sensitive monthly SOX and other controls and maintain archives that capture evidence of compliance.

In Q4 2015, Risk Management also embraced OneSpan Sign. For the Operations Analyst, adoption means efficiency and savings. “It’s basically the turnaround time as well as the efficiency of being able to access the document immediately and sign it electronically as opposed to sending an email to a risk officer,” she says. “And not having to make sure they are near equipment where they can print and fax or scan it back in. With OneSpan Sign, it’s immediate – which is really important, otherwise missing the deadline could mean an audit point for that particular LOB.”

Results: Closing Time Cut By Half; Customer Satisfaction Improves

In Treasury, the transformation of the signing process proved dramatic. Before deploying OneSpan Sign, closing service agreements took an average of four days. “Now,” says the bank’s SVP of Treasury Management, “we’re down to two days or less. When I first came into my role, I was getting emails two to three times a week from frustrated clients and regional sales managers. They said, ‘This process is confusing.’ Since we’ve started using OneSpan Sign, I haven’t heard any of that. I can’t tell you the last time I got an email from a frustrated client.”

Today, Treasury has e-sign enabled approximately ~60 forms, with 200 employees handling 600-700 agreements each month through OneSpan Sign. While some of the paperwork is simple, other agreements involve multiple signatures from different signatories on documents as long as 20 pages. Regardless of complexity, OneSpan Sign secures the signatures and records the complete audit trail, without adding additional steps that could create confusion or delays. Instead of managing signatures through email— where important messages can get lost among the 50 – 150 emails employees get each day— employees appreciate having one central OneSpan Sign in-box with alerts for tracking signing progress.

Given the success at Treasury, the bank plans to scale OneSpan Sign across its enterprise, one LOB at a time, including its client contact center, private wealth team and account openings team. Additional successes with Strategic Sourcing and Risk Management have reinforced the argument for adoption.

Getting buy-in from the bank’s other business lines and their retail customers, he anticipates, will not be difficult. “I tell people: Let me email you a link so you can e-sign the agreement. And then you just open it up on your phone or your iPad or your desktop, and click to sign. I promise you, it’s a much better experience.”