The Bank of Montreal eSignature business case that led to Gartner & Celent Awards

This month, Gartner announced that BMO Bank of Montreal won a 2017 Gartner Eye on Innovation Award. Bank of Montreal was named the winner in Gartner's Most Innovative Digital Business Model category.

According to Gartner, "Bank of Montreal's Digitization Program is re-engineering the bank's sales, service and operations processes to enable straight-through processing, automate low-value-adding tasks, strengthen operating controls and eliminate paper from the ecosystem."

Gartner went on to say, "The eForm + eSignature capability enables fully paperless processes and eliminates manual steps, including reducing human error, lead times on processes and allowing customers to interact with the bank in the channel of their own choosing."

This comes on the heels of another analyst award for the bank's eSignature and e-forms deployment, the Celent Model Bank 2017 Award for Process Automation.

To celebrate our customer's innovative digital transformation and these two prestigious awards, we've summarized our most popular Bank of Montreal webcast. Recorded in 2017, Making the Case for eSignature features Abe Karar, former Director of Business Process & Digitization at Bank of Montreal, speaking about how the bank built the business case for electronic signatures. In this role, Mr. Karar spearheaded the bank's e-signatures and e-forms initiative.

Making the case for eSignature

In the age of the consumer, the number one driver that is moving banks to adopt electronic signatures is customer experience, but it can be challenging to know where and how to begin when making the case for eSignatures. This webcast explores a successful approach by Bank of Montreal and examines the strategies around developing a business case that outlines the realistic benefits and costs of an e-signature solution.

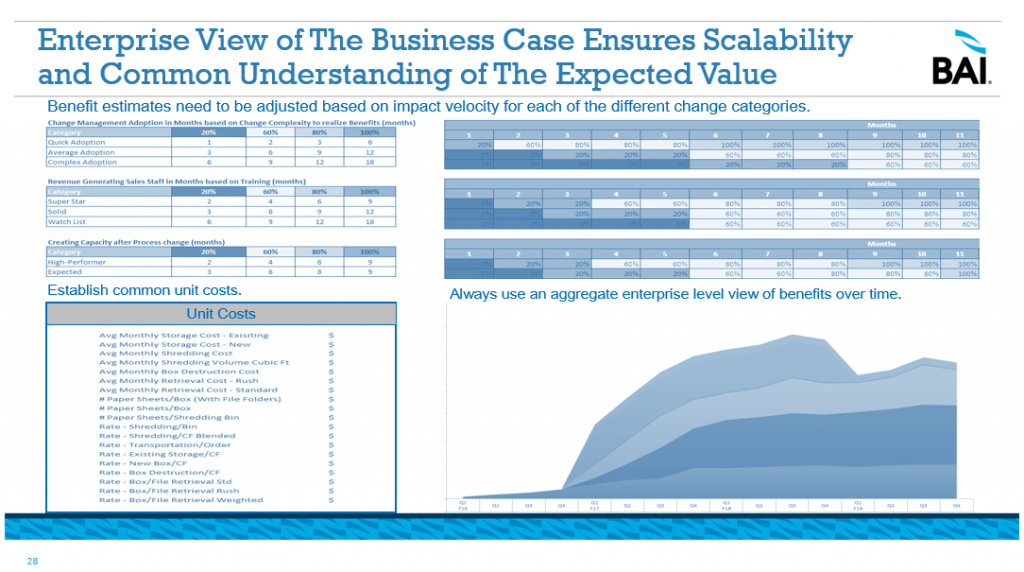

A compelling ROI story based on data is crucial to building an impactful business case that stands out amongst the competing priorities within banks’ IT organizations. But how does one do that with something as intangible as customer experience? It is easy to look at too many metrics and get wrapped up in calculating the expected ROI. Taking data and expressing it in context to articulate value in a universal way (a common language, if you will) is key, and Bank of Montreal did just that.

Adding context to data

Bank of Montreal asked themselves, what’s one thing that everyone has in common across all lines of business within the bank? Paper. Telling a compelling ROI story all boiled down to this one unit. Once this commonality was identified, BMO looked more deeply into the inefficiencies caused by using mass amounts of paper:

- 92 million sheets of paper printed annually at branches

- 464 million sheets of paper in secure, offsite storage

- 760 million sheets of paper shredded annually

When Bank of Montreal looked collectively at all paper used across the bank on an annual basis, they ended up with 1.6 billion sheets. It was clear BMO had a problem.

Do the math

Once the total amount of paper was determined, BMO divided the total cost of this paper by the total number of sheets and ended up with a unit cost of $0.08/sheet. With this in hand, they were now able to build a business case for any line of business to use e-signatures by determining value using a simple calculation:

- Volume of sales (X)

- Documents used for each sale (Y)

- Sheets of paper used for each document (Z)

- Unit cost (U)

- Value (V)

- X x Y x Z x U = V

Build once, use many

Based on firsthand experience, Mr. Karar recommends presenting your business case in the context that the numbers you’ve calculated are conservative, since e-signatures are widely used throughout banking. Not only do you want to look at the point of view of the initial use case – you want to do everything with an eye on the larger expansion of electronic signatures over time because so many banking processes require signature approvals.

Optimizing processes can eliminate a siloed approach to projects, as was the case with Bank of Montreal. Why is this important? Highly reusable processes and technologies allow you to scale faster, build solutions smarter, and get them to your staff sooner for increased productivity and efficiency, and reduced cost and error.

Benefits for Bank of Montreal

In addition to the hard benefits (revenue increase, cost reduction) and soft benefits (revenue retention, cost avoidance) of paper consumption, Bank of Montreal saw substantial error reduction – among other tangible measurements of success – within the first few months of adopting electronic signatures:

- 92% decrease in scanning errors

- 66% drop in missing files

- 8 million sheets of paper saved

Eliminating paper was not just a cost-cutting play, it was also an experience play. Non-financial value really spoke to the enhanced customer experience, which was at the core of BMO’s transformation. Simplifying process allowed Bank of Montreal to spend more time with customers and form those human connections so important in the age of the consumer.

Tools & insights for building your business case for eSignature

- Read the Bank of Montreal case study